As I write this on June 10, 2020, this question is more relevant than ever. The stock market has surged since its lows in March, and yet unemployment is high and many industries, including professional sports, travel and retail shopping are either shuttered or set to operate at far less than full capacity. And yet as the market moves ever higher, the only explanation can be, "But all that's priced in."

A similar, though less dramatic, dynamic exists in every market — does the going rate for a particular commodity include my observations about it, or do I possess some unique information or insight about that information that gives me an edge?

Let's take the sports betting market as an example. If an NFL team is getting seven points, and you think its young quarterback is underrated and making a significant leap, you might want to bet on it. But the quarterback's performance to date is public knowledge, so in order to justify the bet, you have to believe the meaning of his performance — its upward-pointing directionality, perhaps — is not fully appreciated by those willing to lay the points.

But how could that be? The market number — the point spread in this case — is the aggregate of everyone who believes as you do that better things are ahead and also those who believe regression for the young quarterback is coming, now that perhaps defenses have more tape on him. The spread is the equilibrium between the two sets of beliefs. And the beliefs need not be uniform — maybe some of the bettors taking the points think the defense is improving. Maybe some of the bettors laying the wood have beliefs about the favorite's quarterback and don't consider even for a second the hard-to-parse track record of the young QB on which you're hanging your hat. You might be reading it wrong, and even if you're reading that part right, you might be missing something more important. There are tens of thousands of individual observations and perceptions going into the line, and you're but one person with a hypothesis.

What I've described above is a case where it's unlikely, though not impossible, you have have an edge in this particular market.

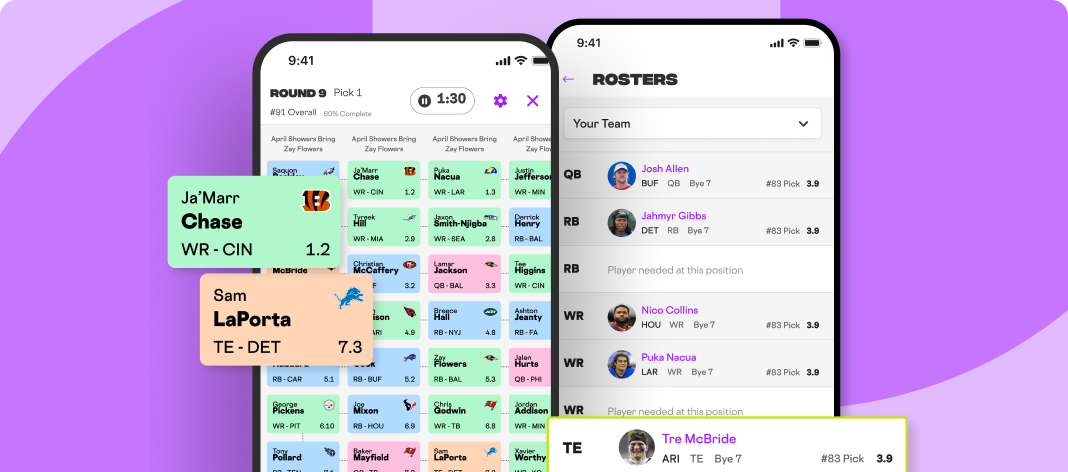

But as a result, many people give up. They buy index funds, avoid betting against the spread and draft their fantasy football teams largely according to average draft position (ADP). They never draft a player above his ADP, and only if someone falls significantly below ADP do they pounce. They trust in the wisdom of the market which surely is superior to their own personal hunches. The collective experience of tens of thousands of drafters is far more vast than one's individual history.

But as more people cede their subjective leanings to the gravity of the crowd, something changes. The crowd is no longer made up of thousands of individuals independently coming to their own conclusions and therefore making up a robust aggregate, but a few people setting the initial benchmarks and everyone else following suit. The wisdom of crowds has morphed into the initial baseline assumptions of a few and massive amounts of groupthink.

In that case, there is a lot of publicly available information that is definitely not priced in. In other words, the more it is assumed to be priced in, the less it is actually priced in. And the more it is not assumed to be priced in, and people are coming to their own conclusions, the more it is actually priced in. This paradox is unresolvable in the sense that there is no optimal strategy all the time. More than a decade ago, I wrote about two styles of drafting, genius vs agnostic, wherein the genius tries to beat the market, while the agnostic takes the values left behind by all the would-be geniuses. Over time, I realized that if everyone is a "genius" the agnostic will clean up. But if everyone is agnostic, a "genius" will usually win.

So the question is what strategy is optimal at a given moment in time. Where are we on the genius/agnostic spectrum in the present moment? That's the first thing to figure out. Have the geniuses capitulated to the agnostics, thrown in the towel? That's when you can crush the market. I imagine the genius/agnostic dynamic in a given market oscillates like a sine wave, and you first need to identify where on the wave the present moment resides.

For the stock market, I think we're in a massively agnostic moment with passive investing and "Don't fight the Fed" becoming the default. It's why I bought some out of the money puts (which have lost money to date) though I still expect them to pay off. (This is not financial advice, by the way.) As for fantasy football, I'm less clear. If I had to guess from my Twitter feed, I think there are plenty of analytics "geniuses" out there purporting to have an edge, and (I hate to admit it because it's against my contrarian nature), you might be better off going agnostic.